Economic employer - many foreign companies need to register in Sweden

Economic employer will affect foreign companies in Sweden. For the hiring out of temporary workers in Sweden, since January 1, 2021, we have an economic employer perspective instead of the previous formal employer perspective. Our tax consultant Frida Grahn explains what this means, how the approach differs from previous Swedish rules and gives some advice to foreign companies.

What is important for taxation going forward is who an employee performs the work for, instead of who pays the salary.

Why new rules for taxation?

The process of new tax legislation for the hiring out of labor in Sweden began already in 2017. This was after the Swedish Tax Agency expressed a wish to the government that employees who work temporarily in Sweden through hiring from a foreign company should also be taxed in Sweden on their income. The background to the desired changes in tax legislation was to create competition-neutral rules.

It has been considered that the 183-day rule has been abused and created an unfair competitive situation in Sweden. This is between companies that employ their own workforce in Sweden and companies that hire labor from foreign staffing agencies. Sweden has previously not been able to tax a temporary employee of a foreign employer.

An economic employer perspective is already applied in most European countries, so it was a natural step for Sweden to take. After Sweden's implementation, Finland is the only Nordic country to have a formal employer entry.

The difference between a formal employer approach and an economic employer approach

Formal employer approach

The main rule for the taxation of temporary work is as follows: If you come to Sweden for temporary work, Sweden as source state has the right to tax you for the income that is attributable to the work done here. Rules on this can be found in the law on special income tax for non-residents, which we usually call SINK. There is an exception to the main rule called the 183-day rule.

183-day rule

According to the 183-day rule, foreign workers do not have to pay tax in Sweden for temporary work in Sweden if the following three conditions are met:

- The recipient of the salary may not stay in Sweden for more than 183 days. This applies continuously for 12 months and not calendar years. This means that every day is the beginning of a new 12-month period.

- The compensation may not be paid by employers domiciled in Sweden or on their behalf. The compensation may not be charged to a permanent establishment in Sweden.

- There must be a foreign employer without a permanent establishment in Sweden for the rule to apply.

But to interpret the rule correctly, we also need to know who the employer is.

Who is the employer?

If we look at the SINK Act, there is a clear definition that says that "the person who pays compensation for work" is the employer. This means that Sweden applies a formal employer’s approach. It can also be called a legal employer’s approach. That is, the person with whom you have entered into an employment agreement and thus also the person who pays the salary for the work, is the employer.

Economic employer

From January 1, 2021, the internal 183-day rule in the SINK Act no longer applies.

For hiring labor, three parties are required. The employee, the formal employer who pays the salary and the client, as we call the financial employer.

If the work is carried out for your own employer, letting according to the rental rule is not relevant and the 183-day rule with tax exemption becomes useful. But if the work is performed for a client, the employee becomes taxable in Sweden. To analyze the tax liability, it is therefore important to know for whom the work is performed. Who is the actual client, the formal employer or someone else?

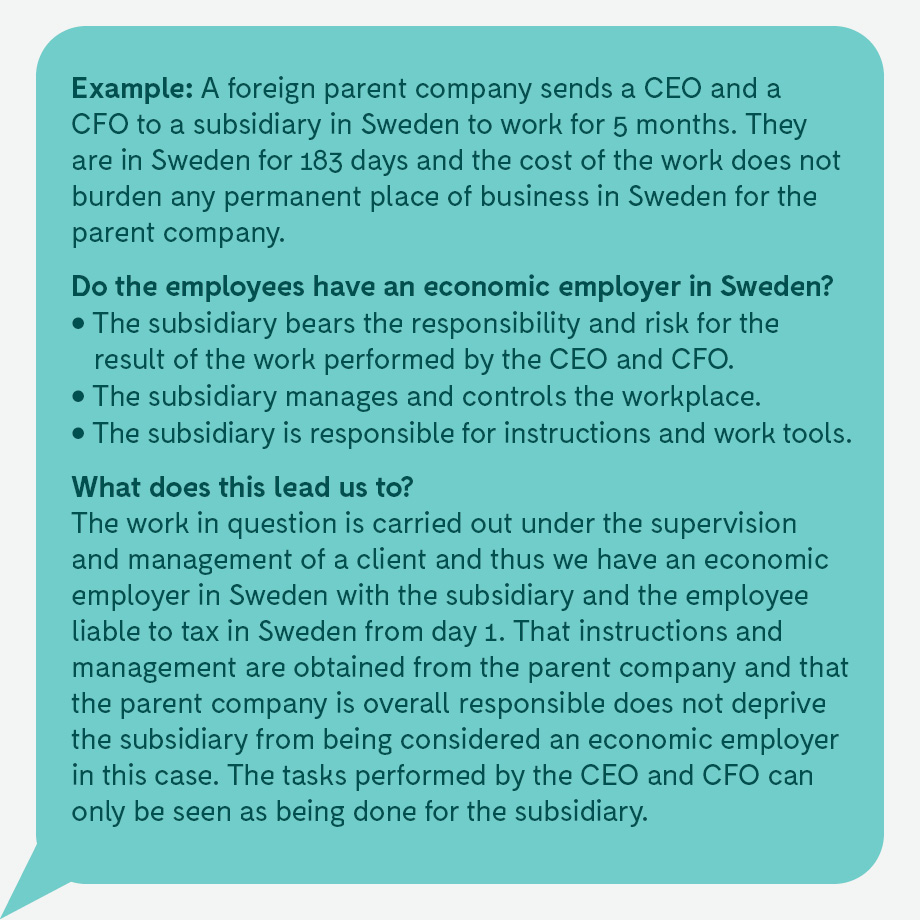

Who is an economic employer?

To find out who the actual client is, you can ask yourself several questions:

- Who gives the employee instructions about the work?

- Who disposes and is responsible for the place where the work is done?

- Where is the cost for the employee invoiced?

- Who makes the tools available?

- Who determines the number of employees and what skills are needed?

- Who has the right to select employees and terminate assignments with employees?

- Who has the right to carry out disciplinary actions relating to the performance of the worker?

- Who decides on the workers vacation and work schedule?

The circumstances do not have any mutual ranking, you should look at them all together and make an overall assessment.

A key issue in this context will probably be who bears the responsibility and risk for the work performed, as well as if the cost has been invoiced to a business in Sweden.

Exception for short-term employment 15/45

Exceptions from the hiring rule have been introduced to highlight certain situations where work in Sweden should not be considered as hiring of labor. This is to ensure that certain undesirable situations are not taxed in Sweden. Examples of these situations are various projects, conferences, trainings and the like where people with employment abroad come to Sweden during short stays to participate, during their working hours.

Therefore, exemptions are allowed for people who work a maximum of 15 consecutive days and a maximum of 45 days in Sweden during a calendar year. The calculation does not include weekends and days off. In these cases, the 183-day rule applies.

Foreign employer

For foreign employers, there are now requirements for registration and reporting even if the employer does not have a permanent establishment in Sweden. This is different from before and means that all foreign employers who have taxable employees in Sweden either due to being an economic employer or due to residence, permanent residence or connection must:

- register as an employer

- make tax deductions

- possibly pay employer contributions

- submit employer declarations (AGI) in Sweden

Our advice, ask yourself these questions:

- Will we be affected by the new regulations?

- How many traveling employees in Sweden do we have?

- Who are their partners?

- What work do the employees do?

- What does the travel pattern / travel frequency look like?

- Do our employees have an economic employer in Sweden?

- What do we need to do to meet the administrative and legal requirements?

Make a plan accordingly - Accountor can help in these matters. Welcome to contact us!